claim incentive under section 127

GSTHST Credit and Climate Action Incentive Payment Application for Individuals Who Become Residents of Canada. For dependent children under subparagraph a i and ii above in which case the other may claim only under subparagraph a iii above if otherwise entitled.

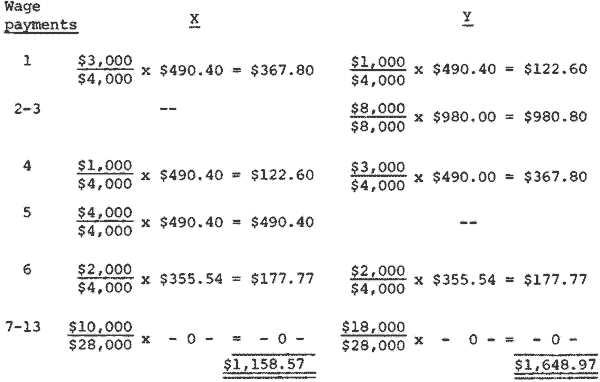

Ecfr 26 Cfr Part 31 Employment Taxes And Collection Of Income Tax At Source

A If real property eligible for a grant or for reimbursement of a property tax or a portion thereof under the provisions of section 12-18b 12-20b or 12-129p or any other provision of the general statutes is located in a town that 1 elected to phase in assessment increases pursuant to section 12-62a of the general statutes revision of.

. Together with the Health Care and Education Reconciliation Act of 2010 amendment it. It supported standards-based education reform based on the premise that setting high standards and establishing measurable goals could improve individual outcomes in education. Person liable for tax under section 583.

APRIL 11 1963. Looking for Used Chevrolet Cruzes for sale. Total on-demand streams week over week Number of audio and video on-demand streams for the week ending September 22.

Public Law 116-127 is amended-- 1 in subsection a. Calculation of Cumulative Net Investment Loss CNIL to December 31 2021. To Our Venerable Brethren the Patriarchs Primates Archbishops Bishops and all other Local Ordinaries who are at Peace and in Communion with the Apostolic See and to the Clergy and Faithful of the entire Catholic World.

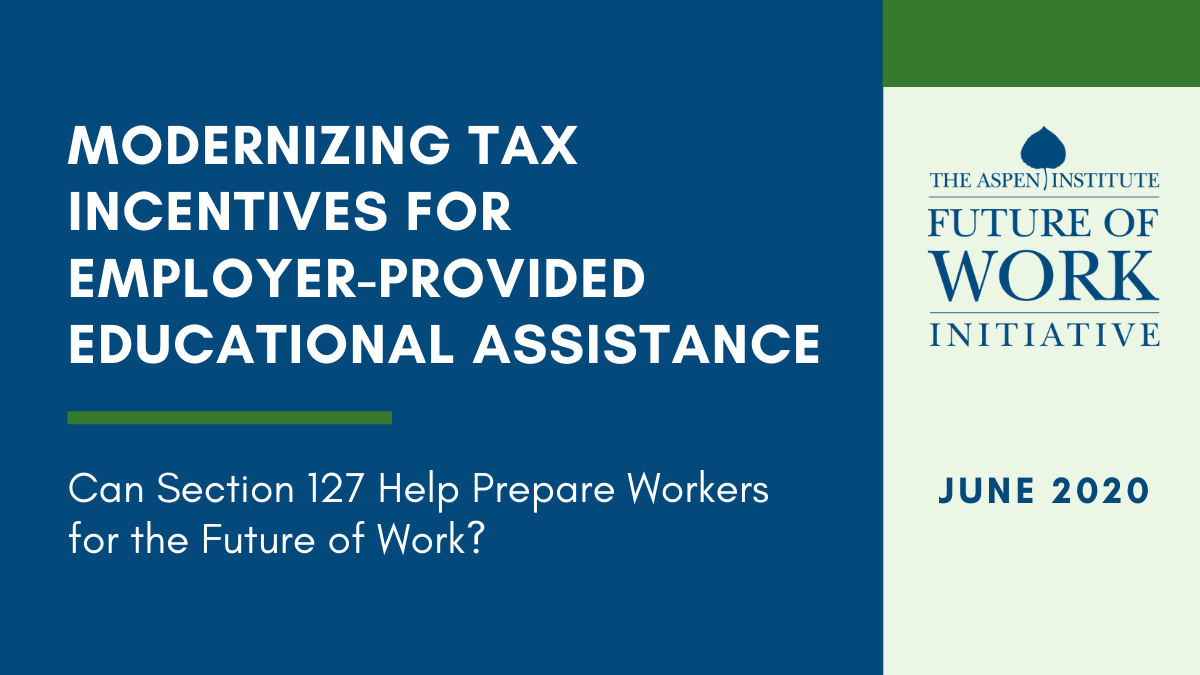

Many employers were unable to take advantage of the temporary incentive. ENCYCLICAL OF POPE JOHN XXIII ON ESTABLISHING UNIVERSAL PEACE IN TRUTH JUSTICE CHARITY AND LIBERTY. Form OR-40 Oregon Individual Income Tax Return for Full-year Residents.

The Statute of Monopolies 1624 and the British Statute of Anne 1710 are seen as the origins of patent law and copyright respectively firmly establishing the concept of intellectual property. News is sometimes called hard news to differentiate it from soft mediaCommon topics for news reports include war government. Code section 9817b ERISA section 717b and PHS Act section 2799A-2b provide that out-of-network rates for air ambulance services may be determined through open negotiation or an IDR process that is largely identical to the process provided for in Code section 9816c ERISA section 716c and PHS Act section 2799A-1c provided the out.

Content Writer 247 Our private AI. An ITC may be. Income charged under section 583.

2 Despite subsection 1 this Act does not apply to a employees described in subsection 3 who are employed in a farming or ranching operation referred to in subsection 4 or to their employer while acting in the capacity of employer of those employees and. Form OR-243 Instructions Claim to Refund Due a Deceased Person. Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified educational expenses.

Election by a Member of a Partnership to Renounce Investment Tax Credits Pursuant to Subsection 12784 2011-10-19. Form OR-243 Claim to Refund Due a Deceased Person. In the context of coordinated effects efficiencies may increase the merged entitys incentive to increase production and reduce prices and thereby reduce its incentive to coordinate its market behaviour with other firms in the market.

Act of Congress that reauthorized the Elementary and Secondary Education Act. In pre-industrial societies there is rarely a concept of childhood in the modern senseChildren often begin to actively participate in activities such as child rearing hunting and farming as soon as they are competentIn many societies children as young as 13 are seen as. If you are a partner not actively involved in the partnership and not otherwise involved.

Type of other income Enter this description in the Specify area for line 13000 of your T1 return. As a condition of receiving funds under section 2001 a State educational agency shall not in fiscal year 2022 or 2023 reduce State funding as calculated on a per-pupil basis for any highest poverty. Federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23 2010.

Engine as all of the big players - But without the insane monthly fees and word limits. Find stories updates and expert opinion. History Child labour in preindustrial societies.

It included Title I provisions applying to disadvantaged students. 21 In accordance with staff regulations 121 122 123 and 124 the revised Staff Regulations and Rules are effective as from 1 January 2018. The No Child Left Behind Act of 2001 NCLB was a US.

Tool requires no monthly subscription. Electing Under Section 217 of. Charge to tax on income from sales of patent rights.

As a result the Consolidated Appropriations Act signed into law on December. Latest breaking news including politics crime and celebrity. Literary property was the term predominantly used in the British legal debates of the 1760s and 1770s over the extent to which authors and publishers of works also had rights deriving from.

This may be provided through many different media. Find the best deals on a full range of Used Chevrolet Cruze from trusted dealers on Canadas largest auto marketplace. Person liable for tax under section 587.

The Affordable Care Act ACA formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare is a landmark US. T2SCH403 Saskatchewan Research and Development Tax Credit. The gross amount is in box 118.

B Part 2 Division 4 Overtime and Overtime Pay. Efficiencies may therefore lead to a lower risk of coordinated effects in the relevant market. Exceptions to charge under section 583.

News is information about current events. Attachment of Bank Accounts Realisation of dues from Debtors Attachment Sale of properties Arrest and Detention of the Employer Action under Section 406409 of Indian Penal Code and Section 110 of Criminal Procedure Code Prosecution under section 14. Business income loss multi-jurisdictional Enter this amount at amount 5A of Form T2125 and report the income on line 13500 of your T1 return.

Form OR-40 Oregon Individual Income Tax Return for Full-year. Categories of speech that are given lesser or no protection by the First Amendment and therefore may be restricted. In the United States some categories of speech are not protected by the First AmendmentAccording to the Supreme Court of the United States the US.

Non-refundable tax credits can be renounced on or before the date by which the RD tax credit would otherwise reduce any deduction of the corporation because of federal paragraph 371d or reduce the corporations qualified expenditures under any of subsections 12718 to 20. Income charged under section 587. Section 1101 of the Families First Coronavirus Response Act 7 USC.

Child labour forms an intrinsic part of pre-industrial economies. Word of mouth printing postal systems broadcasting electronic communication or through the testimony of observers and witnesses to events. The purpose of this document is to clarify the position of the Canada Revenue Agency CRA regarding investment tax credits when administering the scientific research and experimental development SRED legislation under the federal Income Tax Act and the Income Tax Regulations11 Overview of SRED investment tax credit.

A sections 16 and 18 of Part 2 Division 3 Hours of Work. Over 500000 Words Free. Constitution protects free speech while allowing limitations on certain categories of speech.

Sales of patent rights.

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

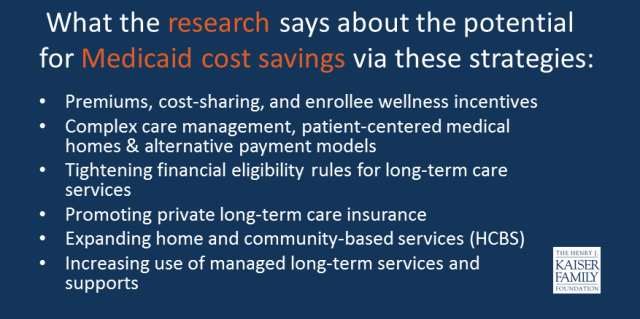

Strategies To Reduce Medicaid Spending Findings From A Literature Review Issue Brief 9050 Kff

Nota Penerangan Ca Advisory Chartered Accountant Melaka Facebook

2020 Cares Act Repay Employee Student Loans Up To 5 250 Tax Free Extended Through December 31 2025 Core Documents

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Amazon Com Green To Gold How Smart Companies Use Environmental Strategy To Innovate Create Value And Build Competitive Advantage 9780470393741 Esty Daniel C Winston Andrew Books

Federal Register Medicare Program Contract Year 2023 Policy And Technical Changes To The Medicare Advantage And Medicare Prescription Drug Benefit Programs

What Tax Breaks Are Available For Alternative Education Class Central

Modernizing Tax Incentives For Employer Provided Educational Assistance Can Section 127 Help Prepare Workers For The Future Of Work The Aspen Institute

The Effect Of Subliminal Incentives On Goal Directed Eye Movements Journal Of Neurophysiology

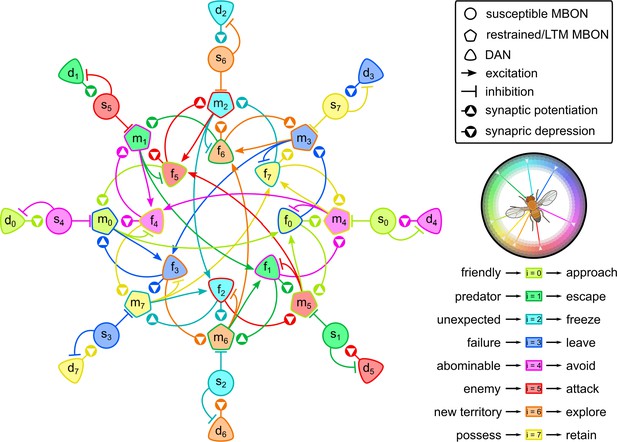

An Incentive Circuit For Memory Dynamics In The Mushroom Body Of Drosophila Melanogaster Elife

Modernizing Tax Incentives For Employer Provided Educational Assistance Can Section 127 Help Prepare Workers For The Future Of Work The Aspen Institute

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Comments

Post a Comment